Commercial -

Whangarei commercial market update – Q2 2024

See below for a summary of the biggest trends in the Whangarei commercial market, plus an outlook on the next 12 months.

Biggest Trends

Tight industrial markets

Industrial markets are facing low vacancies due to ongoing demand for warehousing. Industrial rental rates have been growing across the region, particularly for prime properties.

Flight to quality driving activity in the office market

Tenants are seeking higher quality offices to improve the working experience for staff, particularly as offices compete with work-from-home. New office developments in the CBD are expected to add to the revitalisation of the area.

Prices stabilising for development land

Softening yields and higher construction costs have taken the pressure off prices for development land. Construction costs are starting to stabilise as supply chain issues are resolved and subcontractors become more readily available.

Outlook for the next 12 months

Commercial property market subdued

The local market is experiencing similar trends to those seen nationally, with generally lower sales volumes and some sub-sectors experiencing downward prices. Leasing activity is expected to remain reasonably buoyant.

Two-step rents

The flight to quality is resulting in low vacancies and rental growth amongst better quality properties. Lower quality properties are needing higher incentives to maintain face rents amongst weaker demand.

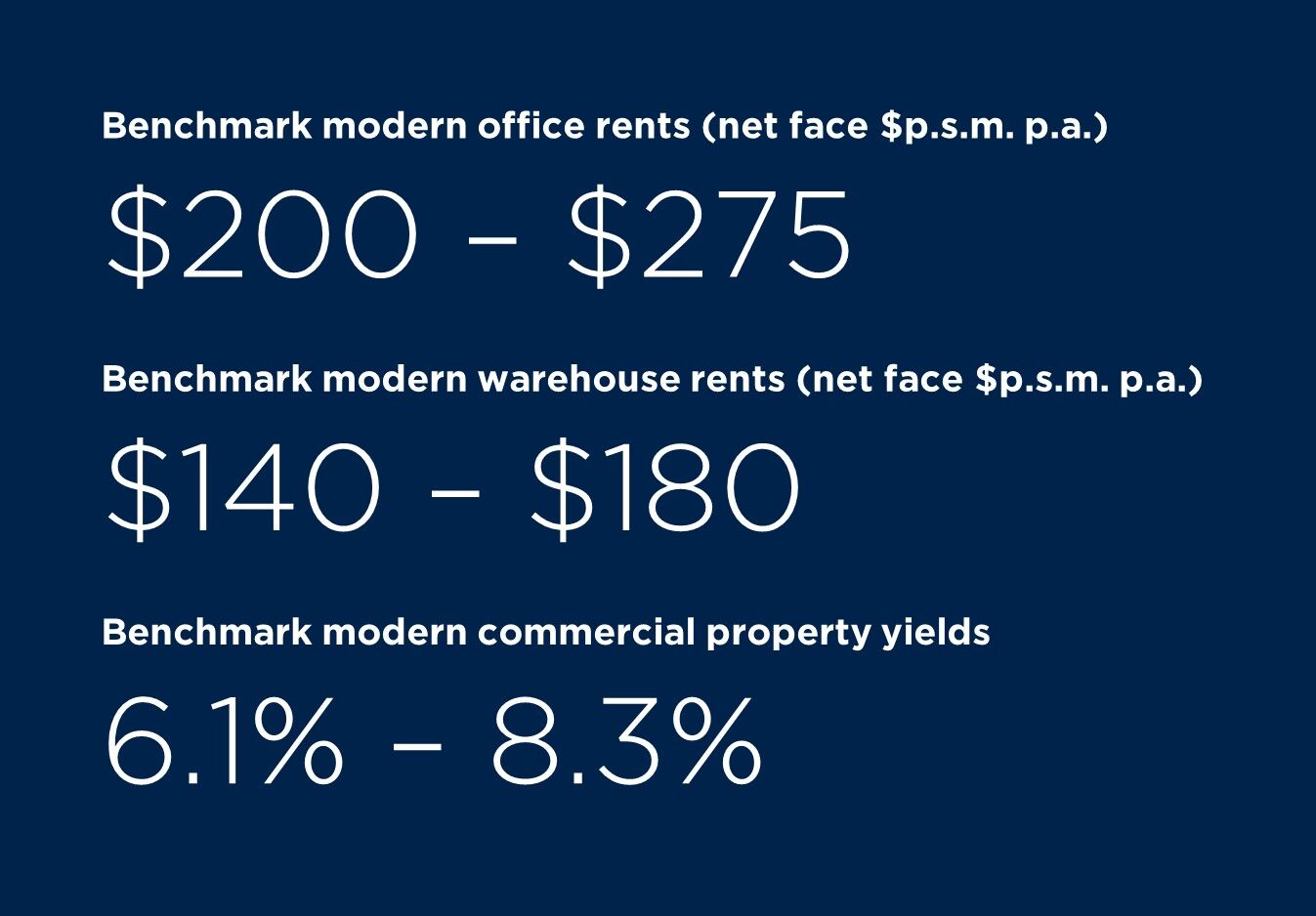

Yields stabilising at higher levels

Rising interest rates have led to a softening of yields across most markets. Signals that inflation and long-term interest rates are peaking means yields are likely to stabilise at higher levels. Lower numbers of sales transactions means there is less evidence available to showcase this trend.